How To Apply For Food Stamps For A Foster Child?

Contents

- How much money do you get for fostering a child?

- Can foster child be claimed on taxes?

- Can you claim foster child on taxes IRS?

- How do I claim my foster child stimulus check?

- What state pays the most for foster care?

- Does foster care pay for daycare in California?

- Do you get paid to adopt a child?

- Do foster parents get food stamps in Florida?

- Can you make a living from fostering?

- What benefits do foster parents get in Florida?

- Can you work and be a foster parent?

- What disqualifies you from being a foster parent?

- How much do adoptive parents get paid in California?

- What is a Level 3 foster carer?

- What is a Level 1 foster carer?

- What are the negatives of foster care?

- Can I post pictures of my foster child on Facebook Illinois?

- How do foster carers fill in tax returns?

- What is the child tax credit for 2021?

- Can you use foster care income on an FHA loan?

- Which parent should claim child on taxes the one who makes more or less?

- Are foster parents legal guardians?

- What support is available to foster carers?

- What is the additional child tax credit 2020?

- When can you claim an adopted child on your taxes?

- Which state has the best child welfare system?

- Conclusion

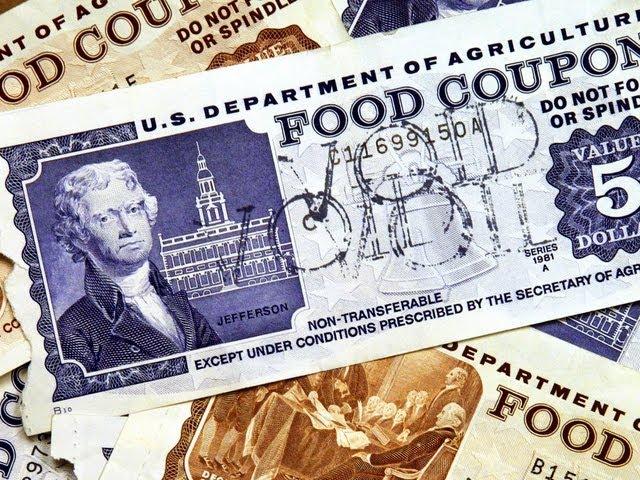

Similarly, Do foster parents get food stamps in California?

Important Information for Parents and Caregivers of Children and Adolescents P-EBT benefits are immediately available to school-aged adolescents in foster care. Families with children in foster care, including those in Family Maintenance programs, are not required to apply or fill out any papers.

Also, it is asked, Do foster parents get stimulus money?

Is it possible for a Resource Parent to get a Stimulus Payment for a Foster Child? If the resource parent reported a foster kid as a dependant on their tax return in 2018 or 2019, and is otherwise income-eligible for a payment, they will get an extra payment for that child.

Secondly, How much do foster parents get paid in California 2021?

California pays foster parents an average of $1000 to $2,609 a month to assist with the costs of caring for the kid.

Also, How much do foster parents get paid in Florida per month?

Foster parents in Florida get paid $429 per month each kid under the age of five, according to the Florida Department of Children and Families. Foster parents in Florida who have children in foster care between the ages of 6 and 12 are compensated $440 per month per kid.

People also ask, How much do foster parents get paid in California 2020?

each month between $1000 and $2609

Related Questions and Answers

How much money do you get for fostering a child?

£11,000 in personal allowance plus a fixed rate of £10,000 In addition, each kid under the age of 11 receives a weekly rate of tax relief of £200 and each child above the age of 11 receives a weekly rate of £250.

Can foster child be claimed on taxes?

If you contribute at least half of the kid’s support and fulfill other dependent-claim conditions, you may be able to claim the foster child as a dependant. You may claim a foster kid as a dependant on your return in the same manner you claim a child as a dependent.

Can you claim foster child on taxes IRS?

The Internal Revenue Service of the United States has said that a foster kid may be deemed a qualified child, at least for the tax year 2021. Go to https://www.irs.gov/credits-deductions-for-individuals/ to discover whether you qualify for the Advance Child Tax Credit or the Earned Income Tax Credit.

How do I claim my foster child stimulus check?

You can’t get a stimulation check by any other means. If you were not required to file a tax return in 2019 and no one listed you as a dependant, the IRS has established a form where you may submit your personal information to get paid.

What state pays the most for foster care?

Minnesota provides among of the highest compensation rates for foster care parents, according to the Star Tribune.

Does foster care pay for daycare in California?

Yes! is the quick response.

Do you get paid to adopt a child?

Is it possible to get compensated for adopting or fostering a child? Adoption: This isn’t a job, believe it or not.

Do foster parents get food stamps in Florida?

Foster children and teens are automatically eligible for free meals. Foster families (including relatives and nonrelatives) might receive these benefits on behalf of the children in their care if a state has authorized the Pandemic EBT program.

Can you make a living from fostering?

“Yes,” is the quick response. Being a foster parent and caring for a kid in need is a rewarding experience in and of itself, but there are also financial advantages. Because there is little time away from the job as a foster parent, it is not the same as working outside the house.

What benefits do foster parents get in Florida?

Foster parents are compensated with “board checks,” which are monthly stipends for the care they offer. The money you will get, however, will not be considered income. These stipends are intended to assist you in meeting your foster children’s daily requirements for food, clothing, housing, and other miscellaneous expenditures.

Can you work and be a foster parent?

You may have a family and work at the same time. If you have prior experience caring for or working with children, it might be considered an advantage, but it is not required. This will help you deal with any concerns that may develop with the kid who has been placed in your care.

What disqualifies you from being a foster parent?

You may not be able to become a certified foster parent if you don’t have enough money. 2: The applicant or a member of his or her family is deemed to be unfit to provide safe and adequate care. The applicant has a physical or mental health problem that would prevent him or her from properly caring for children.

How much do adoptive parents get paid in California?

For qualified adoption expenditures such as reasonable and necessary adoption fees, court charges, attorney fees, and other expenses directly linked to the legal adoption of the child, parents may be reimbursed up to $400 per child. . AgeRate0-4 $8425-8$9109-11$95912-14 $1,0041 more row

What is a Level 3 foster carer?

The City and Guilds Level 3 Diploma for the Children and Young People’s Workforce is a competency-based certification earned via the examination of skills, knowledge, and competences in the workplace. This certification is for anybody interested in working with children and young people.

What is a Level 1 foster carer?

money given to the caregiver You will be given an orientation and required to attend basic core training courses as well as obtain some experience caring for foster children when you initially begin fostering. You will be on level 1 throughout this time.

What are the negatives of foster care?

Foster care is bad for your health, according to a new study. Depression is seven times more frequent in this group. Six times more likely to have behavioral issues. Anxiety is five times more probable. Attention deficit disorder, hearing difficulties, and visual problems are three times more common.

Can I post pictures of my foster child on Facebook Illinois?

Foster families and children in care are no different. If the kid’s identity as a teenager in care is not revealed, a foster family may publish photos of the child in their care on a social networking site.

How do foster carers fill in tax returns?

Unless you are caring for a specialised placement, you may prepare your tax return using Qualifying Care Relief, which does not require you to record receipts. You will, however, need to save your fostering service’s remittance slips and, if they supply one, your yearly summary.

What is the child tax credit for 2021?

The Child Tax Credit was extended for 2021 as part of the American Rescue Plan, which was signed into law on Ma. It has risen from $2,000 per kid in 2020 to $3,600 per child under the age of six in 2040. It has been raised from $2,000 to $3,000 for each kid aged 6 to 16.

Can you use foster care income on an FHA loan?

If you obtain money from the state or a county-sponsored agency for providing foster care for children, you may use it to secure a mortgage. Foster care income is deemed acceptable steady income if the borrower has provided foster care services for at least two years.

Which parent should claim child on taxes the one who makes more or less?

It is normally more advantageous for the kid to be claimed by the parent with the greater income. However, if that parent’s income is too high to qualify for the Earned Income Credit or the Child Tax Credit, the children should be claimed by the other parent.

Are foster parents legal guardians?

Foster parents do not have legal guardianship of their children, but in rare instances they may seek for a Special Guardianship Order (SGO).

What support is available to foster carers?

Foster parents should have access to a range of services given by their fostering agency, including formal supervision, peer support, after-hours help, respite care, and independent support.

What is the additional child tax credit 2020?

You may, however, be eligible for the Additional Kid Tax Credit, which enables you to get a return of up to $1,400 of the $2,000 Child Tax Credit per child. After your tax payment is reduced to zero, you will get a check for the leftover Kid Tax Credit (up to $1,400 per child).

When can you claim an adopted child on your taxes?

You may claim the credit the year after you spent the necessary costs if the adopted kid was born in the United States or is a resident alien. However, if the adoption is completed in the same year that the associated costs begin, you may claim the Adoption Credit for that year.

Which state has the best child welfare system?

Massachusetts, which came in first place overall in the report for children’s well-being, received high marks in each of the four major categories, including health, where it ranked first in the country thanks to a slight decrease in childhood obesity (24 percent, down 2% from the previous year) and a low rate of children

Conclusion

“Can you apply for food stamps for foster child” is a question that has been asked many times. The answer is yes, but the process can be difficult.

This Video Should Help:

Foster parents can apply for food stamps in Texas. They must meet certain requirements, and the process is not easy. Reference: can foster parents get food stamps in texas.

Related Tags

- can foster parents get food stamps in california

- foster care vehicle grant

- can foster parents get food stamps in missouri

- financial assistance for foster parents

- emergency foster care pay