How To Report Self Employment Income To Food Stamps?

Contents

- Do I have to declare self-employed income under 1000?

- How do I declare self-employment income?

- Do I have to declare self-employed income?

- Does self-employed count as employed?

- What disqualifies you from getting food stamps?

- How do I file taxes if I get paid cash?

- What happens if you dont report self-employment income?

- How do I report cash income?

- Can I claim food expenses self-employed?

- How much can you earn self-employed before paying tax?

- How do I avoid paying tax when self-employed?

- Do you have to report small income?

- Do I need to register self-employed straight away?

- How do I report self-employment income without a 1099?

- Can I be self-employed without a business?

- Is self-employment income business income?

- What are the 3 types of self-employment?

- What is the difference between being employed and self-employed?

- What are 3 disadvantages of being self-employed?

- How many hours do you have to work to get food stamps?

- Did food stamps increase this month?

- Can college students get food stamps?

- Conclusion

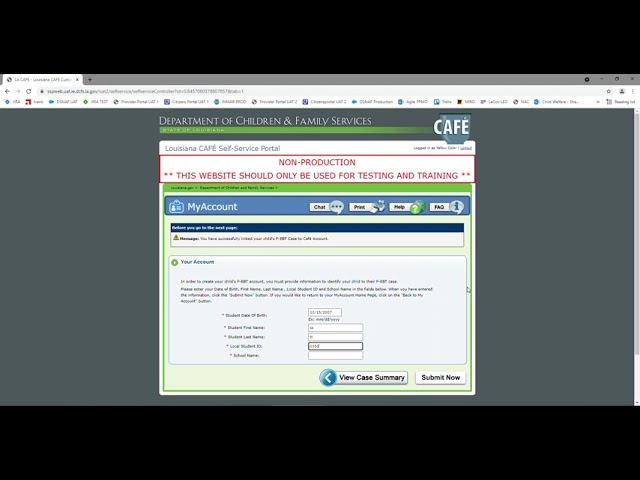

For public programs like SNAP, independent contractors are considered self-employed. The SNAP application on DTAConnect.com asks for your “type” of income. Check the box for “self-employment” if you’re doing ridesharing or delivery work. Then, in the area that asks for your “gross income,” enter your expected pre-tax net income.

Similarly, Can I claim benefits if I am self-employed?

If you or your spouse is self-employed or considering becoming self-employed, you may be eligible for welfare payments to supplement your income.

Also, it is asked, What is self-employment income?

Self-employment income is money earned by providing personal services that cannot be classed as wages since there is no employer-employee connection between the payer and the payee.

Secondly, How does snap determine your income?

Because SNAP families are anticipated to spend around 30% of their income on food, your allocation is determined by multiplying your net monthly income by 0.3 and deducting the result from the maximum monthly allotment for your family size.

Also, How do I report babysitting income without w2?

You must, in fact, file. If you make money as a contractor, consultant, freelancer, or other independent worker, the IRS considers you self-employed and has your own firm. Instead of a W-2, you get a 1099-MISC (Box 7) or a 1099-K (Box 1a), or you receive cash, check, or credit card sales transactions.

People also ask, What can I claim if I’m self-employed?

List of acceptable costs for self-employed people Supplies for the office. You may make a claim for office supplies such. Equipment for the office. Location for a business. Transport. Costs of legal and professional services. Stock / raw materials Marketing. Insurance for professionals.

Related Questions and Answers

Do I have to declare self-employed income under 1000?

Self-employment income refers to the money you’ve made or sold as a result of your side company. If your self-employment income is less than £1000, you won’t have to pay tax on it since your taxable earnings will be nil.

How do I declare self-employment income?

Fill out the ‘Report your income and spending to-do’ on your account to report your earnings online. You must phone the Universal Credit helpdesk to report if you are unable to report online. Make contact with Universal Credit.

Do I have to declare self-employed income?

You do not have to report your income if it is less than £1,000. You must register with HMRC and complete a Self Assessment Tax Return if your income exceeds £1,000 per year. It’s vital to realize, too, that you can’t deduct business expenditures if you claim this allowance.

Does self-employed count as employed?

You are deemed self-employed if you are a company owner or contractor that offers services to other firms. See our Self-Employed Individuals Tax Center for further information on your tax duties as a self-employed (independent contractor).

What disqualifies you from getting food stamps?

Individuals on strike, all persons without a documented immigration status, certain students attending college more than half-time, and some immigrants who are legally present are all ineligible for SNAP, regardless of their income or possessions.

How do I file taxes if I get paid cash?

You must record cash as a form of payment to the IRS if you received it as a form of payment for your services. To appropriately record your cash income, utilize IRS Form 1040 or 1040-SR.

What happens if you dont report self-employment income?

It is a severe problem and a federal and state felony to fail to record self-employment income. This is a kind of tax avoidance. For failing to pay your taxes, you may be fined a fee, interest will be assessed on the amount not paid, and you may be imprisoned and sentenced to jail.

How do I report cash income?

Form 8300, Record of Cash Payments Over $10,000 Received in a Trade or BusinessPDF, is used to report the payment. The BSA E-Filing System of the Financial Crimes Enforcement Network may be used to file Form 8300 online. E-filing is simple, fast, and safe.

Can I claim food expenses self-employed?

If you can show that you spent the money on food and drink as a business cost, you may claim it back. The usual rule is that you may claim a meal as subsistence if it is not part of your regular working schedule.

How much can you earn self-employed before paying tax?

Self-employed people are entitled to the same tax-free personal allowance as employed people. The basic personal allowance for the 2020/21 tax year is £12,500 (£12.570 in 2021/22). Your personal allowance is the amount of money you can make before having to pay income tax.

How do I avoid paying tax when self-employed?

If you are self-employed, there are four ways to keep your taxes low. Costs of driving. You may deduct vehicle expenses if your self-employed revenue comes from running a ride-hailing or delivery company via platforms like Uber or Lyft. Expenses for a home office Deductions for depreciation. Election for S Corporation.

Do you have to report small income?

Yes, you must record any income that is subject to US taxes on your tax return unless it is designated a gift. The $600 limit is only an IRS requirement for the payer to be deemed required to submit Form 1099-MISC.

Do I need to register self-employed straight away?

For example, if you launched a firm or became self-employed in July 2020, you must register your company by October 5, 2021. Just in case anything goes wrong, you should not wait until the last minute to start the registration procedure.

How do I report self-employment income without a 1099?

You should submit a Schedule C with your company revenue and costs to disclose your earnings. You’ll also have to pay a self-employment tax. Independent contractors who received money but did not get a 1099 Form should maintain track of their profits, estimate them, and submit them at the end of the year anyway.

Can I be self-employed without a business?

You don’t need to register a formal corporation to be a self-employed business owner. If you perform odd tasks for money, sell the occasional short story, or have a day job and a side business, you are self-employed, according to the IRS.

Is self-employment income business income?

If their company is a sole proprietorship or partnership, self-employed income is classified and reported in the same manner as business income. As a result, being self-employed has no negative influence on your tax return.

What are the 3 types of self-employment?

One of three legal structures are available for your company. The easiest method to establish a company is as a sole trader. A partnership is formed when a firm is run by at least two persons. Limited liability corporation (LLC) – the firm is a distinct legal entity from the persons who operate it.

What is the difference between being employed and self-employed?

The basic rule is that if you work for someone else and do not carry the risks of operating a company, you will be an employee. If you have a trade, profession, or passion, you are self-employed since you own the company and are responsible for its success or failure.

What are 3 disadvantages of being self-employed?

What are the drawbacks of working for yourself? There are no employee perks (e.g. sick pay, holiday pay) Unpredictable earnings. Long working hours are a possibility. Responsibilities and pressures have increased. There is no structure. Loss is a possibility. Adding to the documentation (tax etc.)

How many hours do you have to work to get food stamps?

80 hours of work

Did food stamps increase this month?

Furthermore, the Biden administration said that during the length of the epidemic, it would offer $1 billion in additional SNAP benefits each month to the approximately 25 million SNAP families in the United States that are qualified for the maximum benefits. Starting in May, these families will get an extra $95 in SNAP benefits each month.

Can college students get food stamps?

According to the USDA, college students must fulfill the basic Supplemental Nutrition Assistance Program (SNAP) eligibility standards as well as be enrolled less than half-time at their school. Students who satisfy the prerequisites and are enrolled at least half-time may be eligible for an exemption.

Conclusion

This Video Should Help:

The “self-employment income report form” is a document that must be filled out and submitted to the government in order for an individual to receive food stamps.

Related Tags

- how to calculate self-employment for food stamps

- how does snap verify income

- calfresh self-employment statement example

- when do i have to report income to snap

- medicaid self-employment income form