How Does Food Stamps Affect Taxes?

Contents

- What are food stamps?

- How do food stamps affect taxes?

- Who is eligible for food stamps?

- How do I apply for food stamps?

- What are the income limits for food stamps?

- How long can I receive food stamps?

- What are the food stamp work requirements?

- What are the food stamp asset limits?

- What can I purchase with food stamps?

- Can I use food stamps if I am not a U.S. citizen?

How Does Food Stamps Affect Taxes?

Food stamps are a government-funded program that provides assistance to low-income families. The program is means-tested, which means that only families who meet certain income requirements are eligible for benefits.

One of the questions we often get asked is how food stamps affect taxes. The answer is that it depends on your individual circumstances. If you are receiving food stamps, you may be eligible for certain tax breaks, such as the Earned

Checkout this video:

What are food stamps?

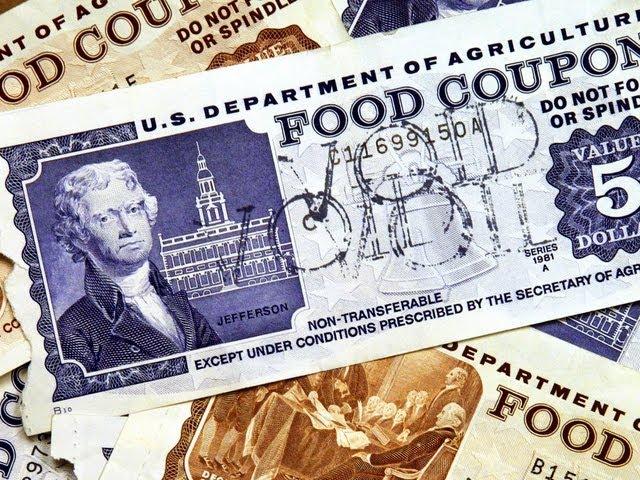

Food stamps are a government-funded program that provides assistance to low-income individuals and families. The program is administered by the United States Department of Agriculture (USDA).

Individuals who participate in the food stamp program receive benefits that can be used to purchase food at participating stores. The amount of assistance that an individual receives is based on their household income and size.

Food stamp benefits are considered to be taxable income. This means that if you receive food stamp benefits, you may be required to pay taxes on those benefits.

How do food stamps affect taxes?

The food stamp program is a government-funded program that helps low-income households afford groceries. Families who participate in the food stamp program receive an EBT card, which can be used to purchase food at participating stores. The food stamp program is administered by the US Department of Agriculture (USDA).

Food stamps are considered to be a form of welfare, and as such, they are subject to federal taxes. Families who receive food stamps are required to pay income taxes on the value of the benefits they receive. However, families who receive food stamps are also eligible for a variety of tax breaks, which can offset the cost of the benefits.

The food stamp program is not means-tested, which means that it is available to all US citizens and legal residents who meet the income requirements. However, non-citizens who meet the income requirements may also be eligible for the program.

Who is eligible for food stamps?

In order to be eligible for food stamps, you must meet certain income and asset guidelines. Households with incomes below 130% of the federal poverty level are typically eligible for food stamps. households with incomes between 130% and 185% of the federal poverty level may also be eligible for food stamps, depending on their household size.

How do I apply for food stamps?

You can apply for food stamps by visiting your local Department of Social Services office or by calling 1-800-522-5006.

What are the income limits for food stamps?

In order to be eligible for food stamps, you must have an annual household income that is below a certain threshold. The specific income limit varies depending on the size of your household, but in general, the larger your household, the higher the income limit. For example, a family of four can have a household income of up to $32,640 in order to be eligible for food stamps.

How long can I receive food stamps?

According to the U.S. Department of Agriculture, the average food stamp benefit is $134 per month, which helps low-income households stretch their budget to buy nutritious food. But how long can you receive food stamps?

The answer depends on a few factors, such as your income, the size of your family and whether you are receiving other benefits. In general, able-bodied adults without dependents can receive food stamps for up to three months in a three-year period if they are working or participating in a work or job training program 20 hours per week. If you are not working or in a job training program, you can receive food stamps for up to three months in a 36-month period.

There are some exceptions to these rules. For example, if you are pregnant or have young children, you may be eligible for food stamps for longer than three months. If you live in certain areas with high unemployment rates, you may also be eligible for food stamps for longer than three months.

If you are receiving other benefits, such as Temporary Assistance for Needy Families (TANF) or Supplemental Security Income (SSI), you may also be eligible for food stamps. To learn more about eligibility requirements and how long you can receive food stamps, visit the U.S. Department of Agriculture’s website or contact your local social services office.

What are the food stamp work requirements?

There are work requirements for able-bodied adults receiving food stamps. ABAWDs, or Able-Bodied Adults without Dependents, must work or participate in a work program for at least 20 hours a week. If they do not meet these requirements, they are limited to three months of food stamps in a three-year period.

What are the food stamp asset limits?

Most people who receive food stamps have very low incomes and few assets. However, the program does have asset limits that vary by state.

In general, households that receive food stamps cannot have more than $2,000 in countable assets (such as cash or bank accounts) or $3,500 in countable assets if at least one member of the household is age 60 or older or disabled. However, some assets are not counted when determining eligibility for food stamps, including:

-One vehicle per household

-A home and lot (there is no limit on the value of the home)

-Life insurance policies

-Personal property

What can I purchase with food stamps?

Food stamps are a government subsidy that helps low-income families afford food. The Supplemental Nutrition Assistance Program, or SNAP, provides eligible households with an EBT card, which can be used to purchase food at participating stores. SNAP benefits can be used to buy groceries, but there are some restrictions on what can be purchased with food stamps.

SNAP benefits cannot be used to purchase alcohol, cigarettes, pet food, paper products, laundry detergent, or other household items. SNAP benefits can only be used to purchase food for human consumption. This includes fresh fruits and vegetables, meat and poultry, dairy products, breads and cereals, and non-alcoholic beverages.

Can I use food stamps if I am not a U.S. citizen?

There is no definitive answer to this question, as each state has its own rules and regulations regarding food stamps and other public assistance programs. However, in general, food stamps are only available to U.S. citizens and legal residents who meet the program’s income requirements. Therefore, it is unlikely that you would be able to use food stamps if you are not a U.S. citizen or legal resident.